Wednesday, March 15, 2023

Watch My Tracer

Illuminate

Christ teaches us then that all things can be used for our healing and benefit and salvation, but that they must first be touched by His grace.In this way our bodies, mere flesh and bones and blood, can become containers of Christ. Our souls activated, we can become lamps of the Holy Spirit; the eyes of our souls, the doors of perception, become seeing, and we see the whole of God's Creation as it really is. We see that every blade of grass and every hill, every tree and every cloud, every drop of rain and every ocean, all creatures and all people, are miracles of God's handiwork, signs of His sacramental presence among us, and we see that we live not in the banal, everyday world, but in potential Paradise, the world as it really is, as God made it first, for we see God the Creator behind all things and all people.And then we too, together with the man born blind, can say:'I was blind, now I see'.Amen.

Tuesday, March 14, 2023

Покаянный псалом

Have you heard the prophecy, Moscow is the the third Rome and a fourth there shall never be. Hitler found that out the hard way. Putin has blasted the West and Anglicanism in particular:

"The Anglican Church is considering a gender-neutral God. May God forgive them for they know not what they do,” he said in February speech, “ ... They distort historical facts, constantly attack our culture, the Russian Orthodox Church, and other traditional religions of our country… Perversion, and the abuse of children are declared the norm. And priests are forced to bless same-sex marriages."

Is he wrong? And if not, does that make him a new Constantine and the Ukraine a Milvian Bridge?

LSP

Vespers Said

Vespers is over and Mexican music fills the air as Eduardo, a good man, tends to several breeds of chickens, roosters and exotic ducks. Jesús, a house down from Eduardo, is running a welding rig and you can see its star bright light from the back deck of the Compound.

He's working on some kind of metal frame which is already a story high, and who knows what this will become. A garage, a small shop, a fortified strong point? Regardless, I'm all in favor, we build, they destroy. That in mind, must get off the hind... and learn Spanish.

Then the phone rang and a young soldier excitedly announced that he'd bought not one, not two, but three uniforms by way of being prepared for deployment. He'd also purchased a large KA-BAR which fast release clips onto his plate rig.

Such martial ebullience was, I learned, part owing to a promotion; he's acting NCO in charge of battalion maintenance prior to a board next month. To that end, he's drawn up a training program involving weekly runs with his team in full gear, plates, helmets and all. Get fit to fight is his message.

Impressed by this I offered a congratulatory well done, and a promise to defray uniform expense. I did not share the story of a Para RSM, veteran of Arnhem and beyond who told this story, "When we were in Malaya we lost more men through self-inflicted knife wounds than anything else."

He was a model of his type and an inspiration to this day. I remember him taking his 1911 pistol out of an armoury safe and showing it to me, he loved that pistol, a keen marksman even retirement.

Then UKGOV made it illegal for law-abiding citizens to own pistols and stole his 1911. What utter, tyrannical, lying, thieving Illuminati shill scoundrels. You see, free men can defend themselves, slaves can't.

That aside, well done boy on the military upvote and plans for combat readiness, let's hope the last part isn't needed and I mean that seriously.

Your Old Pal,

LSP

Monday, March 13, 2023

Bankster Wipeout?

The dominoes keep falling, SBX, Silvergate, SVB, Signature NY and on, with many bank stocks halting trading Monday morning after spectacular Stuka-like nosedives. The issue?

Banks being heavily invested in US Government bonds, a safe have when interest rates are low, toxic underperformers on the reverse side of an apparently risky coin. And lo and behold, interest rates have risen from near zero to approaching 5%, net result?

Underwater balance sheets. You see, when interest rates rise bond prices go down leaving their owners subpar and scrambling for liquidity, cash. And that's hard to get when you're fire-selling assets and depositors are withdrawing funds for greener pastures.

Long story short, select banks were/are out of cash and got shut down. Woe to Oprah, Harry & Meghan and all the rest but that's not all. Has the entire financial sector become infected, is US Government debt effectively a toxic security?

Zerohedge thinks so, it's long but worth the read. Here's an excerpt:

Fifteen years later… after countless investigations, hearings, “stress test” rules, and new banking regulations to prevent another financial meltdown, we have just witnessed two large banks collapse in the United States of America – Signature Bank, and Silicon Valley Bank (SVB).

Now, banks do fail from time to time. But these circumstances are eerily similar to 2008… though the reality is much worse. I’ll explain:

1) US government bonds are the new “toxic security”

Silicon Valley Bank was no Lehman Brothers. Whereas Lehman bet almost ALL of its balance sheet on those risky mortgage bonds, SVB actually had a surprisingly conservative balance sheet.

According to the bank’s annual financial statements from December 31 of last year, SVB had $173 billion in customer deposits, yet “only” $74 billion in loans.

I know this sounds ridiculous, but banks typically loan out MOST of their depositors’ money. Wells Fargo, for example, recently reported $1.38 trillion in deposits. $955 billion of that is loaned out.

That means Wells Fargo has made loans with nearly 70% of its customer’s money, while SVB had a more conservative “loan-to-deposit ratio” of roughly 42%.

Point is, SVB did not fail because they were making a bunch of high-risk NINJA loans. Far from it.

SVB failed because they parked the majority of their depositors’ money ($119.9 billion) in US GOVERNMENT BONDS.

This is the really extraordinary part of this drama.

US government bonds are supposed to be the safest, most ‘risk free’ asset in the world. But that’s totally untrue, because even government bonds can lose value. And that’s exactly what happened.

Most of SVB’s portfolio was in long-term government bonds, like 10-year Treasury notes. And these have been extremely volatile.

In March 2020, for example, interest rates were so low that the Treasury Department sold some 10-year Treasury notes at yields as low as 0.08%.

But interest rates have increased so much since then; last week the 10-year Treasury yield was more than 4%. And this is an enormous difference.

If you’re not terribly familiar with the bond market, one of the most important things to understand is that bonds lose value as interest rates rise. And this is what happened to Silicon Valley Bank.

SVB loaded up on long-term government bonds when interest rates were much lower; the average weighted yield in their bond portfolio, in fact, was just 1.78%.

But interest rates have been rising rapidly. The same bonds that SVB bought 2-3 years ago at 1.78% now yield between 3.5% and 5%… meaning that SVB was sitting on steep losses.

They didn’t hide this fact.

Their 2022 annual report, published on January 19th of this year, showed about $15 billion in ‘unrealized losses’ on their government bonds. (I’ll come back to this.)

By comparison, SVB only had about $16 billion in total capital… so $15 billion in unrealized losses was enough to essentially wipe them out.

Again– these losses didn’t come from some mountain of crazy NINJA loans. SVB failed because they lost billions from US government bonds… which are the new toxic securities.

2) If SVB is insolvent, so is everyone else… including the Fed.

This is where the real fun starts. Because if SVB failed due to losses in its portfolio of government bonds, then pretty much every other institution is at risk too.

Our old favorite Wells Fargo, for example, recently reported $50 billion in unrealized losses on its bond portfolio. That’s a HUGE chunk of the bank’s capital, and it doesn’t include potential derivative losses either.

Anyone who has purchased long-term government bonds– banks, brokerages, large corporations, state and local governments, foreign institutions– are all sitting on enormous losses right now.

The FDIC (the Federal Deposit Insurance Corporation, i.e. the primary banking regulator in the United States) estimates unrealized losses among US banks at roughly $650 billion.

$650 billion in unrealized losses is similar in size to the total subprime losses in the United States back in 2008; and if interest rates keep rising, the losses will continue to increase.

What’s really ironic (and a bit comical) about this is that the FDIC is supposed to guarantee bank deposits.

In fact they manage a special fund called Deposit Insurance Fund, or DIF, to insure customer deposits at banks across the US– including the deposits at the now defunct Silicon Valley Bank.

But the DIF’s balance right now is only around $128 billion… versus $650 billion (and growing) unrealized losses in the banking system.

Here’s what really crazy, though: where does the DIF invest that $128 billion? In US government bonds! So even the FDIC is suffering unrealized losses in its insurance fund, which is supposed to bail out banks that fail from their unrealized losses.

You can’t make this stuff up, it’s ridiculous!

Now there’s one bank in particular I want to highlight that is incredibly exposed to major losses in its bond portfolio.

In fact last year this bank reported ‘unrealized losses’ of more than $330 billion against just $42 billion in capital… making this bank completely and totally insolvent.

I’m talking, of course, about the Federal Reserve… THE most important central bank in the world. It’s hopelessly insolvent, and FAR more broke than Silicon Valley Bank.

What could possibly go wrong?

In a word, everything. Note well, I’m talking, of course, about the Federal Reserve… THE most important central bank in the world. It’s hopelessly insolvent, and FAR more broke than Silicon Valley Bank.

Got that? Smart people are liquid (does this mean loading up your safe with gold, diamonds, silver topped canes, flawless emeralds, DOGE$, worthless fiat and ammo? -- Ed.) and thinking themselves fortunate on being upside Krugerrands. That said, maybe everything will work out just fine as Biden and the Genius Patrol reassured us this morning.

LSP

Sunday, March 12, 2023

Cash is King - Nitty Gritty Dirt Band

Yes, the Compound's sound labs take time off to play requests and here's an awesome offering from Adrienne. Check out Cash, who is notoriously King.

Most especially awesome,

LSP

Saturday, March 11, 2023

Behold The MounteBanks

Friday, March 10, 2023

Bank Run!

Is this the end of the world as we know it? Maybe, if you're an uninsured depositor with SVB (Silicon Valley Bank) which collapsed following a liquidity wipeout brought on by an underwater balance sheet and panic-stricken clients pulling their money out of the fiscal black hole.

Long story short, SVB was out of cash and the FDIC called game over today and shut the bank down. Via Zerohedge:

Last week we detailed BofA's Michael Hartnett's warning that "The Fed will tighten until something breaks". Well, something just broke... SVB's collapse - the second biggest US bank failure in history - dominated any reaction to this morning's mixed bag from the BLS (hotter than expected earnings growth, rising unemployment (especially for Latinos), better than expected payrolls gains).

Things started off badly as SVB crashed 65% in the pre-market before being halted. SVB bonds were puking hard and when the FDIC headline hit, the bonds collapsed further... (and) A number of small/medium sized banks were clubbed like a baby seal...

So far that'd be PacWest Bancorp, Western Alliance Bancorp, First Republic Bank/CA, and Signature Bank/NY. Will the contagion spread? That'd depend on people waking up to find their banks, too, are heavily invested in, ahem, safe havens like T-Bills, which are great until interest rates rise and then they're not.

So let's see how this bizarrely sudden Lehman style fiscal implosion plays out. In the meanwhile, smart investors are going full on into ammunition companies, precious metal and DOGE$. OK, that last one's a long game and a good one.

Beware the Ides of March,

LSP

Thursday, March 9, 2023

Apocalyptic Reflection

Wednesday, March 8, 2023

British Army Fail - Outta Ammo And Men

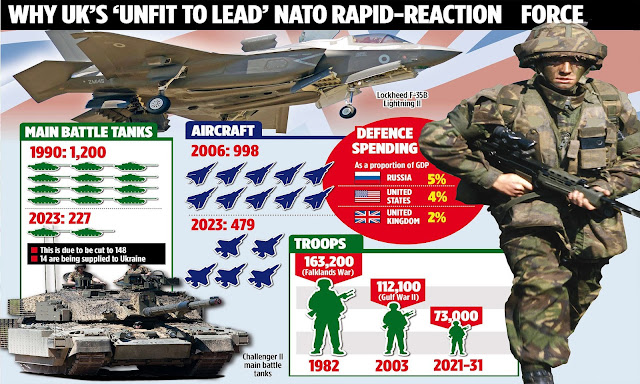

It was a force which went hand in hand, charge to charge in support of the greatest empire the world has perhaps ever seen, but now Britain's armed forces are a hollowed out shadow of their former selves.

Reeling from decades of cuts, the once mighty British Army fields less than 76,000 persons and that number's due to decline to 73,000 by 2025. Of these, one all-arms battlegroup of 25,000, one division, is fit to fight. Except that they aren't, because Whitehall's mandarins have given all their ammo to the Ukraine.

According to the Daily Express, the UK's singular combat division would "run out of ammunition within a few days if required to fight."

Within a few days. Still, not to worry, money's been allocated to rebuild the 2.5bn GBP worth of armaments given to Zelensky's regime by London. But guess what, thanks to asset stripping, aka industrial off-shoring, ammo replenishment will take around a decade to get to the troops.

What does this mean? Most obviously, a grievous security threat, and with it a gamble on several levels. Viz. Never again will we have to fight an industrial peer-to-peer war, allowing save a lot of money by adopting high-end, high-tech, smaller defense/offense solutions.

Gone are the days when we needed actual factories producing hundreds of thousands of shells when one smart bomb will do. In short. We will never, ever have to fight another major war in Europe or, for that matter, anywhere else.

The second wager is like unto the first. If we're called to fight a real war, we'll supply our proxies with arms and destroy our enemy economically until we win, which won't take long.

You can almost picture nameless, unelected bureaucracies shaking hands on a budget well kept, after all, that welfare vote doesn't come cheap, and then... those dam Russkies arrive out of the East, firing thousands of shells a day, every day, going full WWI but with drones and hypersonic glide bombs.

What then, your hand's been called and found wanting, your bluff's been called. So what next? You, the FORPOL reader, be the judge.

Arma Virumque,

LSP